ALTADENA, Calif. — Smoke from the ravenous Eaton Fire had barely cleared when signs began popping up on the charred remains of destroyed homes declaring Altadena was not for sale.

But one month after the wildfire consumed more than 9,400 residences and 14,000 acres in the foothill community north of downtown Los Angeles, the first vacant lot sold for $550,000 cash, $100,000 above the asking price.

Of the 14 properties that have sold to date in fire-ravaged Altadena, at least seven were purchased by developers or investors, including several from outside the U.S., according to a list provided by Jasmin Shupper, founder and president of the nonprofit Greenline Housing Foundation. They were all cash offers, she said.

Housing experts and community members worry the fierce competition could push out longtime residents who want to bring back Altadena’s small-town flavor and diverse enclaves but see that vision slip away as buyers with deep pockets and little historical understanding of the area swoop in.

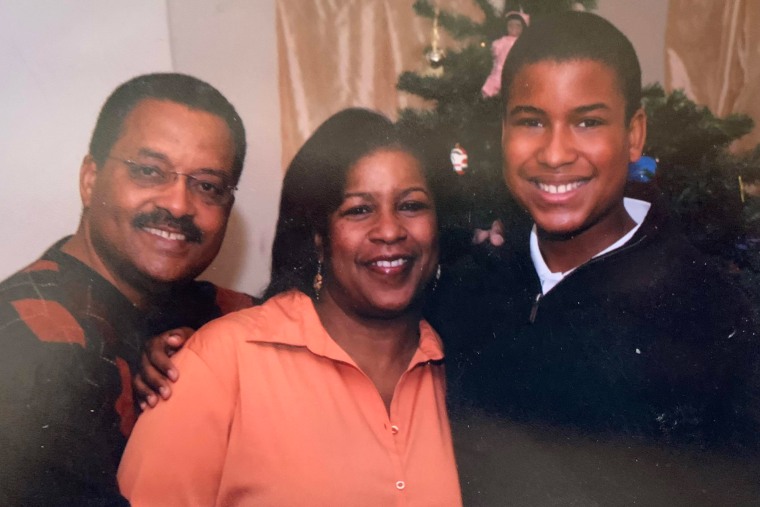

“In our opinion, money isn’t everything and it never will be,” said Darrell Carr, whose Altadena home burned in the fire. “It’s the character of the people.”

“We’re just afraid that we’ll see a bunch of cookie cutters go up and we’ll get a bunch of people coming and going and coming and going and we’ll lose the charm of Altadena.”

To counter this possibility, Greenline began securing long-term, temporary housing for displaced Altadena residents and entering into talks to purchase their burned lots.

Greenline closed on a property for $520,000 earlier this month and is in discussions with a handful of other sellers, Shupper said. The foundation has effectively become a “land bank,” which Pasadena-based lawyer Remy De La Peza describes as a space for immediate and urgent acquisition of land to prevent sales to private corporate interests.

Land banks have been established in cities like Atlanta, St. Louis and Cleveland to develop vacant urban lots for use by local nonprofits, community organizations and affordable housing.

“It’s holding on to land within the bank to buy us time to think about what we want Altadena to look like,” De La Peza said.

Deciding whether to rebuild is a difficult next step for families grieving the loss of their soulful neighborhood. Many want Altadena to remain the same quirky enclave that attracted artists’ studios, small horse ranches and mom-and-pop stores.

Before the January fire laid waste to much of Altadena, the neighborhood of some 42,000 people was a diverse haven for creatives and those who could not afford to buy homes in other parts of Los Angeles. It was one of the few areas in L.A. County exempt from redlining during the Civil Rights era, giving Black people a rare opportunity to own homes and build generational wealth.

People of color comprised more than half of Altadena’s population, with Latinos making up 27% and Black Americans 18%. The Black homeownership rate in Altadena exceeded 80%, almost double the national rate.

More than 60% of Black households were located within the burn area, compared to 50% of non-Black households, according to a UCLA study of the fire’s impact. Nearly half of Altadena’s Black households were destroyed or sustained major damage, compared to 37% for non-Black households.

“Policymakers and relief organizations must act swiftly to protect the legacy and future of this historic community,” said Lorrie Frasure, a professor of political science and African American studies at UCLA and one of the study’s authors.

The housing market, which was already out of reach for many residents, appears to be showing signs of topping pre-fire prices. From 2019 to 2023, the median home price in Altadena was more than $1 million, according to Realtor.com, and the median income was $129,123, according to the U.S. census.

Brock Harris, a local realtor who sold the first Altadena property after the Eaton Fire, expects new home sales to near but not exceed $2 million. He received dozens of cash offers for the first listing and now has five more listings, three of which are in escrow. They all have been cash offers. Prices have settled between $500,000 and $600,000, which is about 50% to 60% of what they were before the fire, he said.

“It’s purely financial,” Harris said of the people choosing to sell.